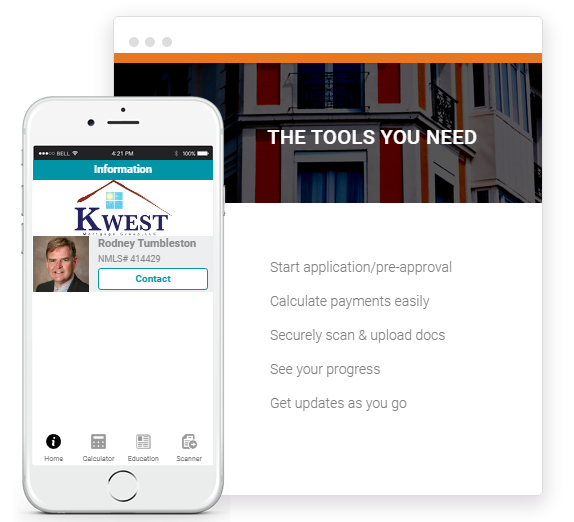

If you have found a home or are contemplating buying or refinancing the one you own now in the next 30 to 90 days this is our most robust option to get that ball moving quickly. It’s supper easy and safe and can be done using our smartphone app, PC, or both.

Just dipping your toes in the water to see if home-ownership is for you? With this tool you will receive a free assessment of your qualifying criteria like income, debt load, and credit by an experienced licensed credit/lending professional at no cost to you. In addition to our free credit coaching you may also receive back current special offers. All this and more and never a hard-pull credit inquiry to find out what home loan options are available for you.

Already know your housing credit scores and other qualifications and just want to find out if that guy with the call-center lender are gal at the retail bank is giving you a fair deal? This quick and easy option allows you to enter your criteria and receive back the most recent rate/term offers available from our panel of wholesale lenders. The accuracy of your free quote is dependent on the accuracy of your entries so try to be as close as possible.

We’re a full service mortgage broker with an experienced staff offering expertise in every area of mortgage lending…from purchase to refinance to home improvement lending.

Copyright ©2023 Kwest Mortgage Group LLC

It looks like you have a request in the works. Pick up where you left off or begin a new $0 down VA Loan quote.