08 Feb FHA Kiddie Condo

turning rent into home equity

The Smart Investment Move for College parents with FHA Kiddie Condo Mortgages

For parents whose children are pursuing higher education, the financial burden of college expenses can be overwhelming. However, there’s a smart and strategic move that can turn these financial challenges into an investment opportunity: opting for an FHA Kiddie Condo Mortgage. In this blog, we’ll explore how parents with children in college can benefit from investing in a home rather than paying rent, creating a valuable asset for the family’s future while enjoying the added financial benefits of lower rates, fees, and down payment requirements compared to buying a second or investment home through conventional financing.

Understanding FHA Kiddie Condo Mortgages:

FHA Kiddie Condo Mortgages aren’t just a pathway to homeownership for young adults; they also present an excellent opportunity for parents to invest wisely while their child is in college. By purchasing a home near the college campus, parents can avoid paying rent and, instead, start building equity in a property.

The program offers the flexibility of the standard FHA programs, but unlike conventional programs it does not require the primary borrower, the student, to demonstrate qualified repayment income. The qualifying income can be exclusively the parents.

Benefits for Parents:

- Equity Building: Opting for an FHA Kiddie Condo Mortgage allows parents to channel the money they would spend on rent into building equity in a home. This equity can serve as a valuable asset for the family’s financial future, whether it’s used for future home purchases, renovations, or other investments.

- Tax Advantages: Homeownership comes with various tax advantages, and parents can leverage these benefits. Mortgage interest, property taxes, and certain expenses related to maintaining the property may be tax-deductible, providing additional financial relief. Additional, unique to SC, the child can declare the home as their primary residence and pay significantly less in annual real estate taxes.

- Flexible Living Arrangements: Having a property near the college campus provides flexibility in living arrangements. Parents can choose to reserve living space for themselves when they visit or opt to sublet space to other students creating additional streams of income.

Financial Edge with FHA Kiddie Condo Mortgages:

Lower Down Payment:

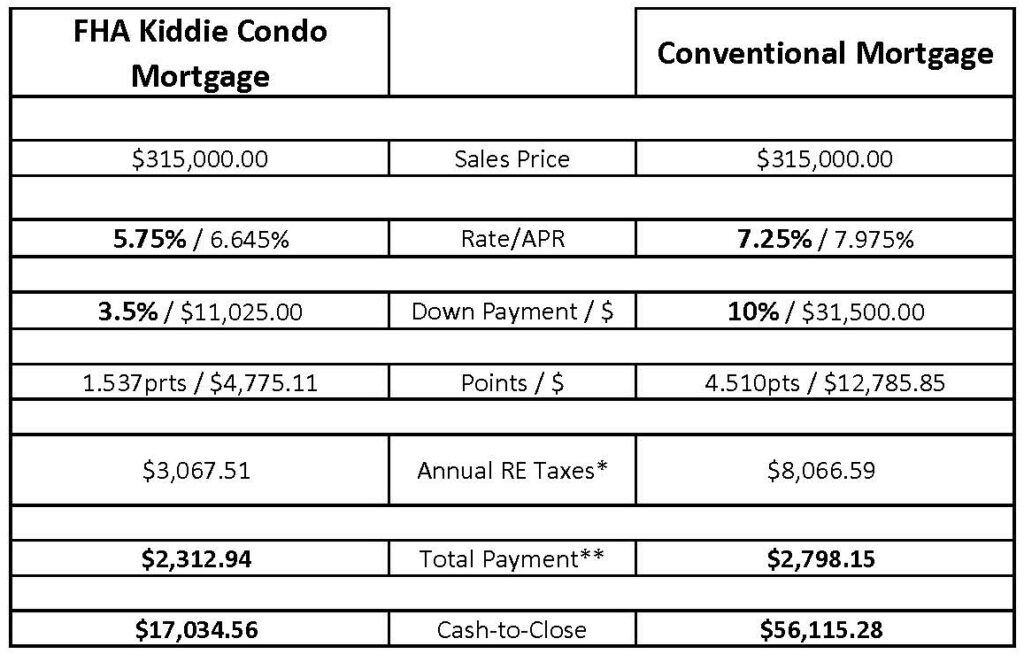

Traditional financing for a second or investment home typically demands a substantial down payment. In contrast, FHA Kiddie Condo Mortgages offer a more affordable entry point, requiring as little as 3.5% down payment. This reduced financial barrier allows parents to allocate funds strategically, preserving liquidity for other investment opportunities.

Lower Rates:

FHA Kiddie Condo Mortgages often come with more favorable interest rates compared to conventional financing for investment properties. Lower interest rates mean reduced overall borrowing costs, enhancing the long-term financial viability of the investment.

Lower Costs:

Conventional financing for investment properties often involves higher fees. FHA Kiddie Condo Mortgages, backed by the Federal Housing Administration, typically have lower fees, contributing to significant cost savings up front and over the life of the mortgage.

Real Life Scenario:

Meet Bill and Hillary, proud parents of Chelsea, a dedicated student-athlete attending a university near Charleston, SC. Faced with exorbitant rents in the area, they embarked on a journey to explore the possibility of homeownership rather than renting throughout Chelsea’s anticipated 5-year program.

Initially, their bank presented a daunting prospect – a hefty 20% down payment and a mortgage rate hovering around 8%. Undeterred, the couple decided to explore alternative options and reached out to Kwest Mortgage on a friend’s recommendation.

Enter Kwest Mortgage, where the names may be changed for privacy, but the terms are as real as it gets. Thanks to their solid credit and other qualifiers, the wholesale lenders through Kwest Mortgage offered Bill and Hillary a more promising deal as of 02/07/2024.

The chosen home, nestled in the heart of Dorchester County, SC, became the focal point of their pursuit of affordable and sensible homeownership. With Kwest Mortgage’s assistance, they are in the process of securing a deal that not only drastically reduces their initial financial burden but also sets the stage for long-term financial stability.

Bill and Hillary’s story isn’t just about buying a home; it’s a testament to the power of exploring options and seeking out tailored solutions. Through Kwest Mortgage, they found a pathway to turn the challenge of high rents into an investment in their daughter’s future education.

*Annual real estate tax estimates are directly from the county tax assessor’s site here: https://www.dorchestercountysc.gov/government/property-tax-services/assessor/tax-estimator based on the assumption the daughter claims the home as her primary residence on the FHA Kiddie Condo mortgage. On the conventional mortgage, assuming the parents own a home and buy as a second home they would not be eligible for the lower rate as you can only claim one home ins SC as a primary residence. **Total payment is PITI(principle, interest, taxes, insurance) and MMI or PMI as applicable.

Ready to explore the possibilities of FHA Kiddie Condo Mortgages and transform your homeownership journey? Learn more about how this smart solution can turn challenges into opportunities for your family’s future. Contact us at Kwest Mortgage, and let’s navigate the path to affordable and strategic homeownership together. Your dream home awaits – discover the key to unlocking it today!

Sorry, the comment form is closed at this time.